per capita tax in pa

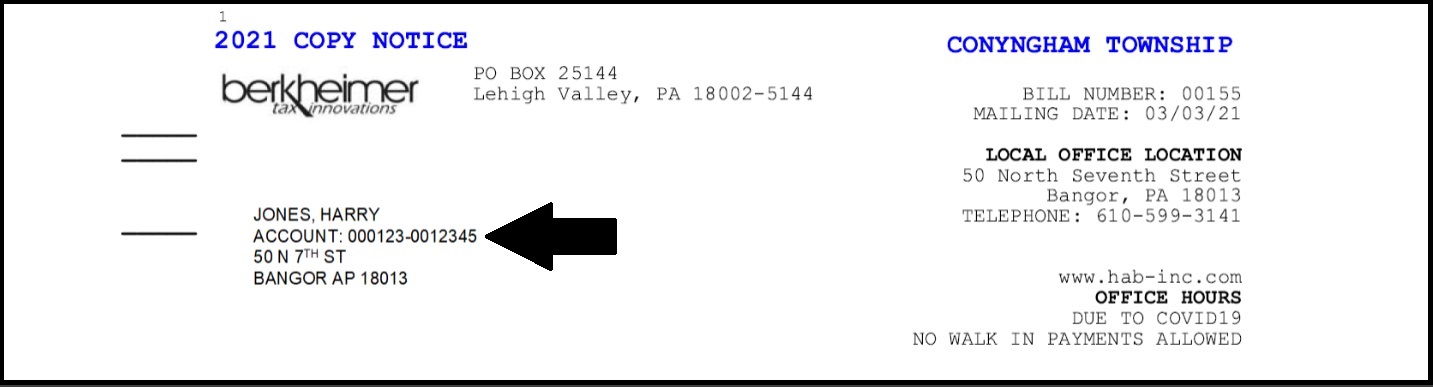

Per capita tax for Unity Twp. If paid on or before 33121 amount due 980.

Exoneration from tax is applicable to the current tax year only.

. Reminder to pay your Per Capita tax bill before December 31st. Municipalities and school districts were given the right to collect a 1000 per capita tax under ACT 511 and School Districts an additional 500. What is a Per Capita Tax.

If you pay after the Face Amount due date in November a 5 penalty is added to your taxes until the end of the year. The Occupation Tax is an Act 511 tax authorized by the Pennsylvania State Legislature many years ago to relieve the school tax burden from resting solely on property owners. The Per Capita Tax and Street Light Assessment is included in your Union Township Real Estate Tax bill.

Steelton Borough Steelton-Highspire School District Paint Borough Delinquent Per Capita only Scalp Level Borough Delinquent Per Capita only Windber Borough delinquent Per Capita only and Shanksville-Stonycreek School District. Penalty of 10 and interest of 1 per month is assessed for payments made on or after November 1 of the tax year. City of Reading.

This tax applies to all residents of the Town of McCandless age 21 and over employed or not employed who reside in the District for any part of the fiscal year. Per Capita Tax is a tax levied by a taxing authority to everyone 18 years of age and older residing in their jurisdiction. Discount Amount Taxes must be.

Contact us to quickly and efficiently resolve your tax needs. The school district as well as the township or borough in which you reside may levy a per capita tax. The City of Corry Per Capita tax is 1500.

1000 annually per individual. The tax has no connection with employment income voting rights or any other factor except residence within the community. Per capita tax information Per Capita taxes are assessed by the Municipality and the Franklin Regional School District on all residents who have attained the age of twenty-one 21.

The rate is 10 per person per fiscal year July through June. Whether you rent or own if you reside within a taxing district you are liable to pay this tax to the district. Reminder to pay your Per Capita tax.

We are the trusted partner for 32 TCDs and provide services to help Individuals Employers Payroll Companies Tax Preparers and Governments. The Per Capita Tax imposed by the North Allegheny School District is also collected by the Town of McCandless. If you pay your bill on or before the discount date in September you receive a 2 discount.

For most areas adult is defined as 18 years of age and older. The per capita taxes in Antis Township are collected by the elected tax collector Susan E Kensinger. It can be levied by a municipality andor school district.

The tax is due if you are a resident for. There is a 2 discount available for payments made in July andor August of the current tax year. Do I pay this tax if I rent.

Per capita exemption requests can be submitted online. A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district. 10010 A per capita tax of 1000 or a legal amount as set by resolution of Council for general Borough purposes is hereby levied and assessed under the authority of the Act of December 31 1965 PL.

You must file exemption application each year you receive a tax bill. We are Pennsylvanias most trusted tax administrator. The municipal tax is 500 and the school tax is 1000 These taxes are due on an annual basis.

If you do not own real estate the Per Capita Tax is still required. Grants school districts the power to levy certain taxes with maximum rates set by the General Assembly. What is the Per Capita Tax.

Access Keystones e-Pay to get started. Keystone offices will be closed on Friday April 15 in observance of Good Friday. City Per Capita Taxes are based on a calendar year from January 1 thru December 31 of the current year.

The flat tax is accepted in September andor October. Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Act 511 of 1965.

Act 511 Taxes Flat All taxes levied on a flat rate basis in accordance with Act 511 of 1965. Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. Normally the Per Capita tax is NOT.

For more information about this tax and the assessments which were recently mailed to PASD residents. Per Capita Tax OR2-1978 10000 Tax Rate. It is not dependent upon employment.

This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. All residents over 18 years of age are required to pay 500. ACT 511 Tax is a Per Capita Tax that can be levied at a maximum rate of 1000.

If both do so it is shared 5050. The Per Capita Tax bill is sent in July. 1256 known as the Local Tax Enabling Act and.

What is difference between an ACT 511 and ACT 679 Per Capita Tax. Is this tax withheld by my employer. B Each local taxing authority may by ordinance or resolution exempt any person whose total income from all sources is less than twelve thousand dollars 12000 per annum from the per capita or similar head tax occupation tax or earned income tax or any portion thereof and may adopt regulations for the processing of claims for exemptions.

Tax Day is Monday April 18 2022. A Per Capita Tax is a flat rate tax levied upon each individual eighteen years of age or older residing within the taxing district. If your income changes you move out of Antis Township or you have any questions about the Per Capita Tax please call Susan E.

2 discount if paid by June 1 490. FAQs Phoenixville Occupational Assessment and Per Capita Taxes. Click PayFile to access our.

Please make payment to the local elected tax collector Bernadette Speer. With an estimated population of 95112 as of the 2020 census it is the fourth most populated city in the state after Philadelphia Pittsburgh and Allentown. Per Capita means by head so this tax is commonly called a head tax.

ACT 679 Tax is a 500 Per Capita Tax authorized under the PA School Code and is addition to the 1000 Per Capita that can be. Is five dollars per individual while per capita tax for Greater Latrobe School. Also known as the Local Tax Enabling Act.

The Wilson Borough Per Capita Tax is mailed the beginning of each new year. Act 511 Taxes for Pennsylvania School Districts Glossary of Terms. The City of Reading located in southeastern Pennsylvania is the principal city of the Greater Reading Area and the county seat for Berks County.

The application form may be used by a PA taxpayer whose community has adopted one or more tax exemptions. Per Capita means by head so this tax is commonly called a head tax. We specialize in all Pennsylvania Act 32 and Act 50 tax administration services.

Both taxes are due each year and are not duplications.

How Much Do You Need To Make To Buy A Home In Your State Home Buying Moving To Another State States

Maptitude Mapping Software Map Infographic Of Turkeys Raised By State Map Mapping Software Infographic

Apac Gni Per Capita By Country Statista

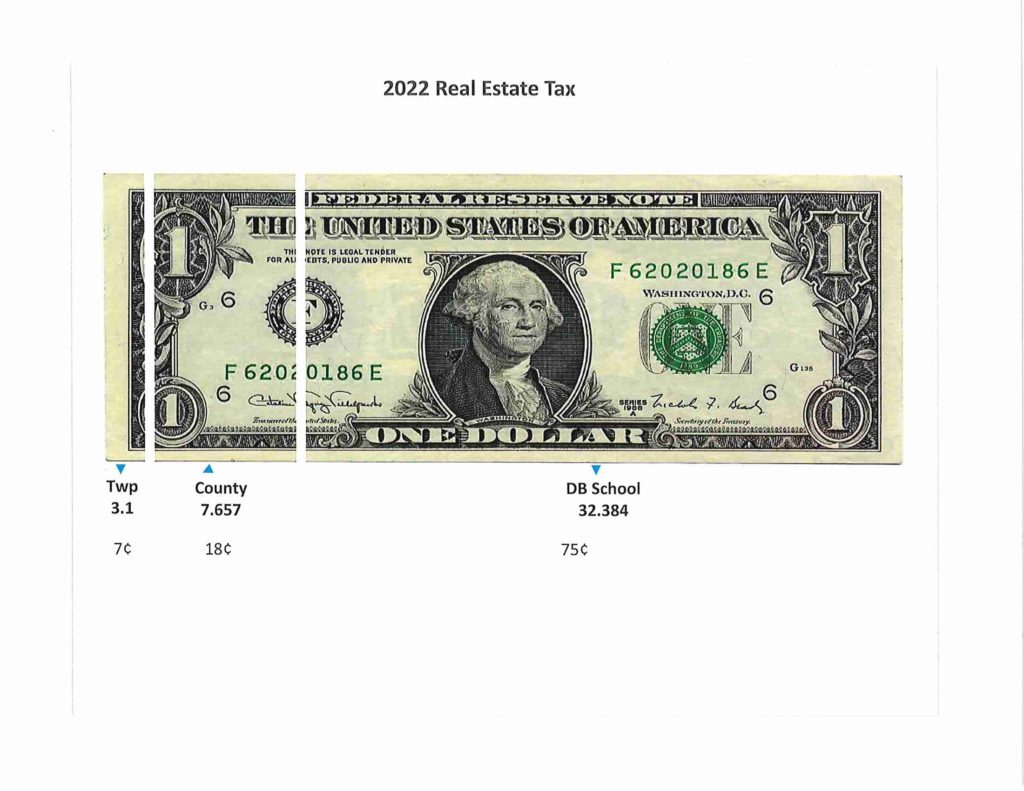

State Local Property Tax Collections Per Capita Tax Foundation

Which States Pay The Most Federal Taxes Moneyrates

Medicare Beneficiaries Out Of Pocket Health Care Spending As A Share Of Income Now And Projections For The Future Via Health Care Medicare Medical Billing

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Retirement Locations Retirement Strategies

How Much Income You Need To Afford The Average Home In Every State The Housing Market Has Not Only Infographs Housing Investi Usa Map Map 30 Year Mortgage

Panama Gdp Per Capita 1950 2022 Ceic Data

42 Timelines Is The Answer Edge Of Chaos Timeline Example Timeline Alcohol

Pin On S S 5 Themes Of Geography

Information About Per Capita Taxes York Adams Tax Bureau

/dotdash_Final_Gross_National_Income_GNI_May_2020-01-53d357d45bae47f29d3c72a98f190f8d.jpg)

Gross National Income Gni Definition

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation